Highly effective financial planners are not just good at delivering great advice; they are also strong leaders.

One of the greatest challenges in the financial planning process is having clients consistently follow through on their plans and achieve the success they desire.

So, leadership is an essential quality for financial planners. In its absence clients will falter, get distracted, listen to the wrong people, and be consumed by the many obstacles to their success.

So, how can you immediately convey leadership?

There are many qualities that a leader can develop, and I believe in an ongoing commitment to keep improving.

Yet there is a foundation that everything else sits upon.

Leadership begins with who you are being

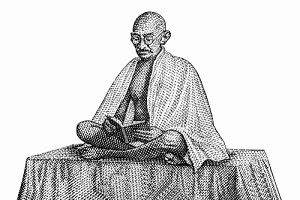

There is a famous story about a woman visiting Gandhi with her young son.

She and her son had travelled a long way and when they eventually got their chance to speak with Gandhi.

He asked how he could help and the woman said, “My son eats far too much sugar, can you tell him to stop?”

Gandhi thought for a moment and then said to the woman to bring her son back in two weeks.

So, two weeks later, after another long journey, the woman and her son met him again. Gandhi looked the boy in the eye and said, “Stop eating sugar!”

The woman, slightly confused, asked “Why didn’t you say this two weeks ago?”

Gandhi replied, “Because two weeks ago I was still eating sugar myself!”

What does this have to do with financial planning?

Gandhi could have easily told the boy to stop eating sugar on their first visit. But he knew that his words would have been hollow and an attempt at leadership would probably fail.

We instinctively know when someone is not congruent.

Who is going to take our advice and follow it if they do not respect us, trust us, or believe us?

In the excellent book, ‘Advice that sticks‘ Moira Somers writes:

“In an era when financial guidance has never been easier to obtain, the citizenry of the developed world has dismal savings levels and record amount of indebtedness. Yet none of the branches of the financial services industry seem to be taking into account the fundamental complexity of human psychology. They just keep on telling people the same old messages about what they should be doing, as though more telling will result in more uptake.”

P.S. A significant element of being a strong leader is to be more coach like in your client interactions. If you want to develop these skills you can begin with my ‘Top 10 coaching book for financial planners’. Click here to go through to post.