Do you ever find your role as a lifestyle financial planner being overly complex?

Would you like it to be simpler, more productive, and more rewarding?

If so, this article considers that there are only three core roles of a lifestyle financial planner.

You will also learn why so many lifestyle financial planners can get stuck in a rut doing work they do not enjoy or find rewarding. More importantly, we’ll look at how you can very quickly get back on track.

Isn’t your time best spent in your area of expertise?

I once worked with a client who was a top orthopaedic surgeon.

His typical working week was always organised around his area of expertise, for which he was very highly paid.

He spent time in the operating theatre, met with patients to consult with them, and kept up with developments within his field.

Essential jobs best not done by you

There were also many things he did not do but were still essential for him to carry out his work. For instance, he did not prepare the operating theatre, run his diary, or do administrative tasks.

As a lifestyle financial planner is there any valid reason you would not treat your role with the same degree of reverence?

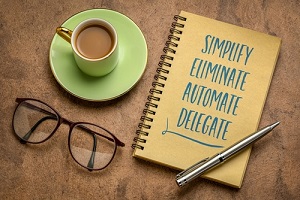

The three core roles of a lifestyle financial planner are:

*Meeting with a client

*Meeting with a prospective client

*Developing yourself professionally and personally (suggestions for career boosting books)

But just like the surgeon, there are also tasks essential to being a lifestyle financial planner that are best not carried out by you.

What is the current balance of your working week?

If you look at your typical working week then how much of your time is spent on tasks that are far better off conducted by someone else?

If it is much more than you want you are not alone, and it is perfectly ok.

Every lifestyle financial planner who wants to make progress faces this situation. Yet as I also know from my own experience, it is a certainty that you are going to get stuck from time to time.

How do you get unstuck and make real progress?

We get stuck because of our thinking gets stuck and we and cannot see a way out.

For instance, you can feel overwhelmed with the size of the task, you might try something new, and it fails, or find it difficult to let go.

You can think of this as being like a log jam – a whole mass of logs blocking a river and stopping the natural flow.

The conventional wisdom is to try and think your way out of it. Only this often fails to work because it is like adding more logs to the pile.

Yet what happens if you raise the water level? The log jam will always sort itself out.

How do you raise the level?

The answer is to allow your mind to relax instead of trying to grind out answers (for a fuller explanation see this TED Talk with Ken Manning).

Once your mind is more relaxed then the secret is to listen more deeply because your own innate wisdom is your greatest asset.

A great example of how this works came from a financial planner I was working with.

He had been stuck in a rut for a while and then happened to go on holiday with his family. As you might expect, his thinking relaxed. As is by magic the answers that he needed came to him without effort and upon returning he began to make great progress immediately.

The crucial point is that you do not need to go on holiday for your mind to relax. When you know how your mind works then you will see that it can relax at any time. So, when you do get stuck it is something very temporary instead of something that lingers on.

The three roles of a lifestyle financial planner

You may have your own version of what your ideal role as a lifestyle financial planner looks like and that’s fine.

As you make progress towards your outcome and happen to get stuck, be easy on yourself.

Acknowledge where you are and be ok with this. This almost seems too simple, yet you will find it highly effective.

The mind naturally wants to return to presence and clarity. We simply have to allow it to do this.

P.S. You can download the FREE REPORT, ‘Magical Client Meetings Everytime’ by clicking here.