As a financial planner have you considered how you can begin to deeply serve a client from the very first moment?

When you meet with a potential client there are likely to be at least three important questions on their mind:

1. Do I like them?

2. Can I trust them?

3. Can they help me?

The world of financial advice continues to be very transactional because this is how people are trained to be.

The approach is:

Diagnose the problem and then provide the solution.

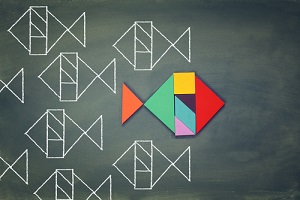

This works entirely in your favour because it provides the perfect opportunity to stand out and be different.

In this article I share ten powerful ways a financial planner can serve a client more deeply right from the get-go.

1. Connect life and money

Money is a tool. In and of itself it has no real value and it is what someone can do with the money or what the money can do for them that matters.

So, all the time the conversation is only about the money there will be a disconnect, which is precisely why many people’s financial planning is dysfunctional.

A conversation that connects money and its meaning in someone’s life is far more valuable because it is all about them and their life.

2. Be willing to move off the safe ground

The safe ground for a financial planner is talking about products, investments, and financial issues. It is safe and comfortable for the financial adviser because this is what they know about.

Moving off the safe ground is being willing to step into the unknown by being deeply curious about the client. What matters to them? What do they really want? How can I serve this person right now?

How often will the client get an opportunity to have such a conversation if it’s not with you? Probably never.

3. Avoid problem solving too soon

There is a temptation for financial planners to go into problem solving mode as soon as they recognise a problem they can solve.

There can be a few reasons for this. Trying to prove their credibility, feeling under pressure to close the business, or simply not recognising the value in being more curious are among the main ones.

Stay curious for longer and discover more about your client.

4. Do not fear raising the tension level

I had a conversation today with a financial planner who said he avoids creating tension in his client relationships because he does not want the client to feel upset.

This is a cop out. Side-stepping ‘difficult’ but often necessary conversations does not serve your client.

The objective is to help the client get what they want. Sometimes this is going to mean telling them the truth or at least how you see it (with kindness and their permission, of course). Check out, ‘Why challenging your clients is great for business’.

5. Deep listening

There is content listening and then there is deep listening.

Listening to content (i.e., the words) is listening for problems to solve and will miss what is behind the words. For example, what is the client really trying to communicate? What is the feeling behind the words?

Deep listening will create far deeper connection and trust with a client than content listening. And very, very few people listen in this way.

6. Be a co-collaborator, not the expert

Having the expertise to provide solid advice is crucial. Yet needing to the be expert is something completely different that is founded in the insecurity of the financial planner. It gets in the way of building a deeper connection with the client.

Clients want to feel your humanness. They want to know you care and needing to be the expert will compromise this.

7. Let go of the outcome

This is a big one. Attachment to outcome is placing your sense of well-being on things going ‘your way’.

This will compromise the connection between you and your client. It will even invite push back from some people because they will sense it.

Learn to stay in the present and do not allow your mind to go into an imaginary future.

8. Ask more questions

The opposite of asking questions is making assumptions. For example, common assumptions that financial advisers make are thinking they know what the client wants, think they have all the information they need, or the client has said everything they need to.

How do you avoid this?

Ask more questions. Even a simple question such as, ‘Have you shared everything you want to share around this issue, or is there anything more?’, can be powerful when you give someone the time and space to reflect.

9. Let the client sell it to themselves

You cannot want something for your client more than they want it for themselves.

Trying to persuade or convince people is often a waste of time and ineffective. The way you can explore someone’s desire and commitment is to ask questions and listen.

Making an important decision will often require a client to change their behaviour. Exploring the question, ‘What makes this worth doing?’ can be surprisingly effective in increasing their commitment.

10. Understand that you are not selling financial planning

Financial planning is not what people are interested in. And if you try to sell financial planning you’ll get far more resistance than you want and is necessary.

What people buy are feelings – peace of mind, freedom, security, safety, choice, and not having to worry are all examples.

Learning to recognise and elicit the feelings that people want takes some understanding and practice, but it is not difficult. It will also pay you back handsomely.

These ten ways financial planners can serve clients deeply from the very first moment are powerful because they implicitly demonstrate trust, rapport, and credibility.

Which one are you most drawn to implementing from your next conversation?

P.S. If you enjoyed this article, you can download a FREE copy of ‘Magical Client Meetings Every Time.’ You will discover the 10 essential keys and use the score sheet to immediately determine your next steps. Click here to download.