How do you become a great financial planner? One who continually has a powerful, positive impact in the lives of your clients?

Of course, there are many attributes but one in particular stands out. Read on to discover what this is and why it is so important.

What do clients look for in a financial adviser?

Clients want to work with a financial adviser who is trustworthy, dependable, personable, and knows what they are talking about.

Yet these are a given, aren’t they?

Put yourself in the shoes of a client. You meet with a financial planner or adviser because you have a problem, or problems, that you want solving.

How might you be feeling?

In The Trusted Advisor by Maister, Green, and Galford, they point out:

“Since clients are often anxious and uncertain, they are, above all, looking for someone who will provide reassurance, calm their fears, and inspire confidence.”

Great financial planners provide strong leadership

What does an effective leader do?

A great financial planner has presence, listens, empathises, and respectfully and skilfully direct the conversation. They are crystal clear with the client about the terms under which they operate and what is required from them. Leaders do not allow role reversal and are never subservient to a client.

As a result, the client feels in safe hands.

A great financial planner is not just a technician

As a financial planner you can pass your exams and get qualified, but this is just the beginning because these alone will not bring you success.

How you are being is equally, if not more important. Let me share a favourite story with you.

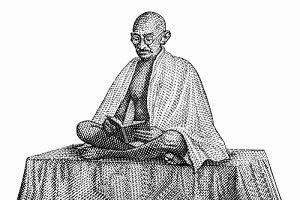

A woman went to visit Gandhi with her young son.

They had travelled a long way, queued for hours, and when they eventually got their chance to speak with him, he asked how he could help, and the woman said:

“My son eats far too much sugar; can you tell him to stop?”

Gandhi thought for a moment and then said to the woman to bring her son back in two weeks.

So, two weeks later, after another long journey, the woman and her son met him again. Gandhi looked the boy straight in the eyes and said, “Stop eating sugar!”

The woman, slightly confused, asked, “Why did you not you say this two weeks ago?”

Gandhi replied, “Because two weeks ago I was still eating sugar myself!”

What do you see in this story?

For me, it is the difference between simply giving advice and leadership.

The world abounds with people dishing out helpful advice yet much of the time it seems to fall on deaf ears.

Good advice is only useful if people follow it. If someone doubts you, does not trust you, or does not respect you, then the chances that they will follow your advice are drastically weakened.

Clients that reject your advice, question your intentions, and would rather follow their own (bad) ideas do not make good clients.

This is not an uncommon problem. On several occasions, I have listened to an adviser complain about clients who reject their advice.

Yet the issue is not with the client. It is a leadership issue that begins with the adviser.

Clients respond to who you are being

Clearly, a client has the right to reject advice. But if this happens you must reflect and ask yourself how things got this far down the road in the first place?

Gandhi could have easily said “Stop eating sugar!” to the boy on their first meeting.

So, why did he send them away?

Because he knew that the state of mind from which you speak is far more important than the words.

Impact does not come from the words alone; it comes from the spirit behind the words. Click here for my recommendations of ’10 books to nourish your spirit’.

P.S. If you want a deeper understanding of the importance of state of mind in building the highest quality client relationships, you can download my free report, ‘What every adviser ought to know about client engagement.’ Click here.