I recently saw a post on social media that shared that the biggest challenge faced by financial advisers and planners is lead generation.

I understand this because if we have a good flow of leads then it keeps business rolling in and everyone is happy, right?

A lack of leads creates all sorts of issues – a lack of new business, financial stress, and slower business growth. So, we want to solve the issue, right?

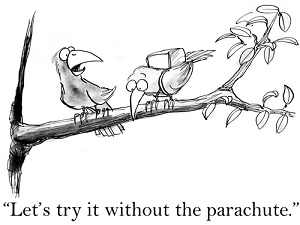

Yet the ultimate answer to this problem is not where you expect it to be.

The conventional approach and what most people think is that they just need to find a good source of leads and then the problem will be solved forever.

This is not my experience because it does not tackle what creates the problem in the first place.

Have you ever considered why lead generation is the biggest challenge faced by financial advisers?

The reason is simple, but not obvious.

It is because lead generation is the area where financial advisers over-think the most and experience more worry, stress, anxiousness, insecurity, and discouragement.

When humans operate from these kinds of feelings and associate them with a particular activity the outcome is predictable.

Things will feel difficult. Ideas will seem hard to come by. When your mind is full you have no space to think anything new.

One result of this is that taking action is avoided or pushed down the list of priorities and it then becomes a self-fulfilling prophecy.

In this situation, it seems as though we need something external to us – like a reliable source of potential financial planning clients – to ride in and save the day because we think the problem is external to us.

Only then do we think we can relax and breathe a sigh of relief.

But let’s just say that someone does find a source of leads and they relax…

What happens when that source of leads for the financial planner dries up or stops working?

This happens all the time.

The world is constantly changing. Financial services today is not the same business it was a few years ago. What worked yesterday will not necessarily work today. What works today may not work tomorrow.

So, what CAN you rely on?

The late Dr. Nathanial Branden was an expert on the psychology of self-esteem and one of the things he used to teach his clients was the understanding that…

‘No one is coming’

No one is coming to save you, solve your problems or live your life for you. No one is coming to bring into your life what you think you need.

One day he was teaching a group this idea of ‘No one is coming’ and one of them said:

“Dr. Branden you say that no one is coming but that’s not true. You came! You came into our lives and showed us how to live with higher and higher self-esteem. And our lives got better and better so don’t say no one is coming, because you came!”

“It’s true”, said Dr. Branden, “I did come. But I came to tell you that no one is coming!”

People do not make real progress through an external ‘quick fix’ – but they do make genuine and lasting progress when they shift inside.

The only reason things can seem limited is because our thinking is limited. No other reason. Ever.

Your mind is genius. With a clear mind, you are resourceful, you have a lot of mental bandwidth, and you begin to see opportunities all over the place.

Again, the outcome is entirely predictable.

P.S. I recorded an audio called ‘What every financial planner should know about getting clients’. You can download it for free by clicking here.