In my career as a financial adviser the training and qualification process was all about pensions, investments, insurances, tax, markets, trusts, risk, and so on.

So, in the beginning this is what I talked to people about because this is what I thought you did.

It did not occur to me until several years later that I was selling something that no one really wanted.

What are clients really paying for?

Of course, people do buy financial products. But why do they buy them?

Theodore Levitt, was an economist and professor at Harvard, and a famous quote of his is:

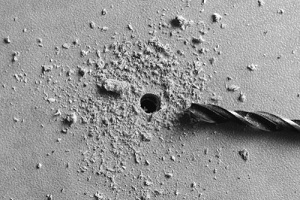

“People don’t want quarter-inch drills. They want quarter-inch holes.”

Financial products are quarter-inch drills. What are the quarter-inch holes that they really want?

They are really buying things like choice, freedom, love, connection, peace of mind, security, living an authentic life, autonomy, happiness, and the possibility of getting what they want.

Why does emotional engagement matter?

The most significant factor in successful long-term client and financial planner relationships is trust.

What creates trust?

Demonstrating that you are deeply, truly interested in understanding your client is what conveys trust. This is not accomplished in a superficial ‘hard fact’ gathering way because anyone can do that. It means going deeper than this and understanding what really matters to them and why.

What are the emotions, feelings, and values that they want the most and want to avoid the most?

When you do this, you are helping to build a bridge in your client’s mind between the financial choices they make and creating and living the life they want. This, in turn, leads to an improvement in their quality of life now.

Yet what does the ‘industry’ do?

It still focuses entirely on technical training. Of course, this is important, but it sends financial planners and advisers out into the world thinking that intellectual conversations about products is what people want.

How to be different from other financial advisers

After many years of thinking that learning the right processes and techniques was the path to creating more value for clients, I discovered there was something more fundamental than this.

I wrote ‘The Client-centred Financial Adviser‘ because of this discovery (and because no one else is talking about it). From chapter one:

‘Right at the very heart of being a truly client-centred adviser is your state of mind. It is not just another factor, it is the factor. Your state of mind affects, more than anything else, the experience your clients have. For example, if you feel self-orientated, under pressure or distracted then this will significantly lower the quality of your meetings and client relationships.

Conversely, when you are functioning at a high psychological level you can facilitate client meetings that deliver enormous value because your clients experience them as inspiring, uplifting, insightful, collaborative and creative.’

With a clear mind you are free to focus entirely upon your client and this makes a huge difference to the quality of your engagement.

PS. If you want to read more on this subject click here.